Master the Technicals

Let’s Crunch!

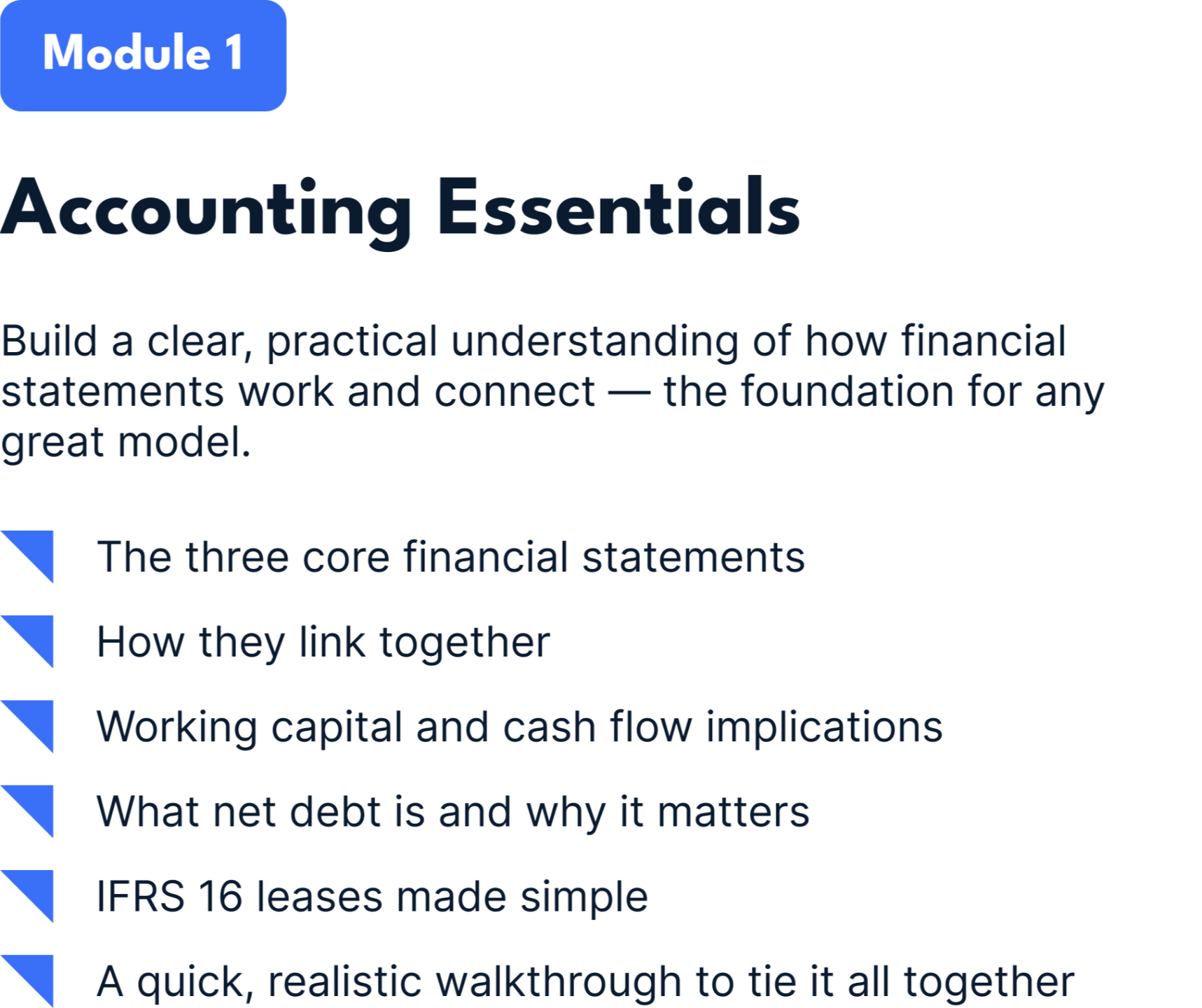

Get a practical mastery of accounting, valuation, merger model and LBO as well as interview technicals expected from IB candidates.

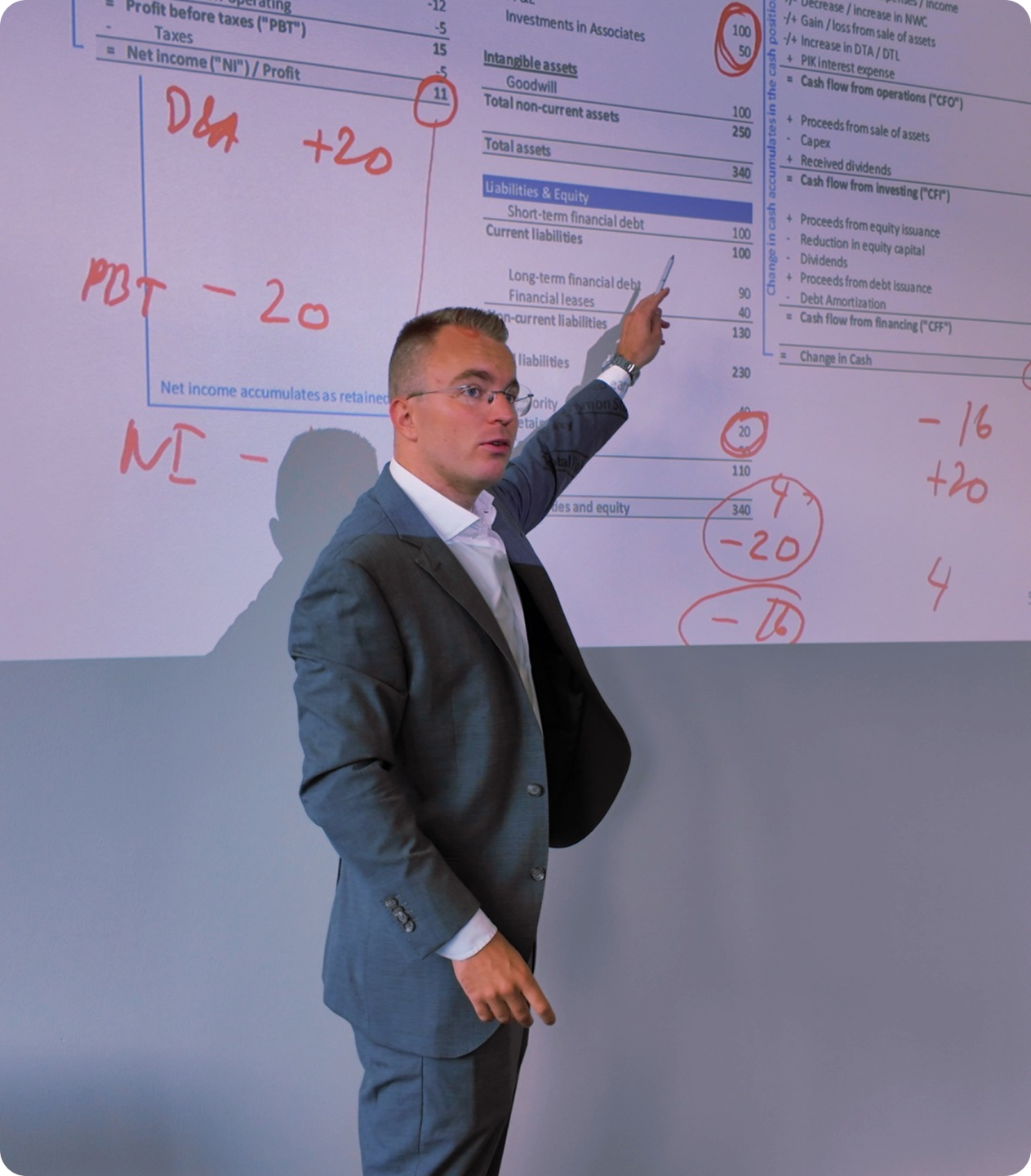

This course is based on the technical training I built and delivered to Swiss IB interns and the frameworks I taught at HSG and Bocconi Master Programs.

What You’ll Learn

This course teaches the core technical knowledge required for IB interviews and analyst tasks. Knowing the basics of finance will certainly help but is not a requirement.

What's Included

Or consider the full bundle if you want the complete IB preparation path: